Manufacturing Equipment Sales Tax Exemption . a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales or use tax rate on qualifying equipment. — machinery and equipment used directly and predominantly in the production of tangible personal property. beginning on july 1, 2014, manufacturers and certain research and developers, and beginning on january 1, 2018, certain. 2017) amended revenue and taxation code (r&tc) section 6377.1,. the manufacturers' sales and use tax exemption (m&e) provides a retail sales and use tax exemption for machinery and. 2017) and ab 131 (chapter 252, stats. assembly bill (ab) 398 (chapter 135, stats. — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions.

from www.templateroller.com

the manufacturers' sales and use tax exemption (m&e) provides a retail sales and use tax exemption for machinery and. — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. assembly bill (ab) 398 (chapter 135, stats. a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales or use tax rate on qualifying equipment. beginning on july 1, 2014, manufacturers and certain research and developers, and beginning on january 1, 2018, certain. — machinery and equipment used directly and predominantly in the production of tangible personal property. 2017) amended revenue and taxation code (r&tc) section 6377.1,. 2017) and ab 131 (chapter 252, stats.

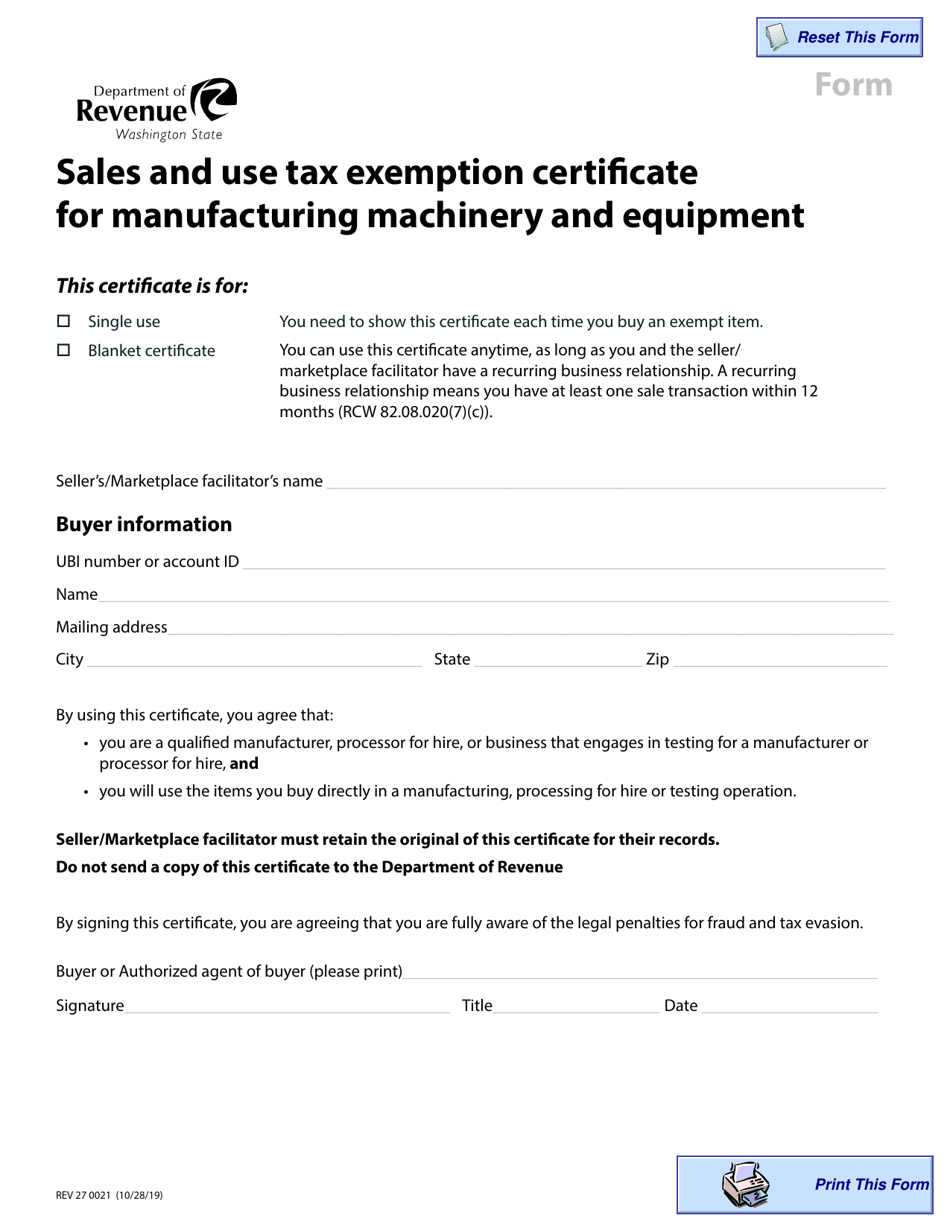

Form REV27 0021 Fill Out, Sign Online and Download Fillable PDF

Manufacturing Equipment Sales Tax Exemption 2017) amended revenue and taxation code (r&tc) section 6377.1,. the manufacturers' sales and use tax exemption (m&e) provides a retail sales and use tax exemption for machinery and. 2017) and ab 131 (chapter 252, stats. 2017) amended revenue and taxation code (r&tc) section 6377.1,. — machinery and equipment used directly and predominantly in the production of tangible personal property. beginning on july 1, 2014, manufacturers and certain research and developers, and beginning on january 1, 2018, certain. — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. assembly bill (ab) 398 (chapter 135, stats. a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales or use tax rate on qualifying equipment.

From jessemosby.blogspot.com

Jesse Mosby Manufacturing Equipment Sales Tax Exemption — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. — machinery and equipment used directly and predominantly in the production of tangible personal property. beginning on july 1, 2014, manufacturers and certain research and developers, and beginning on january 1, 2018, certain. a partial sales and use tax exemption. Manufacturing Equipment Sales Tax Exemption.

From www.pdffiller.com

Fillable Online Fillable Online Farm Equipment Sales Tax Exemption Manufacturing Equipment Sales Tax Exemption 2017) and ab 131 (chapter 252, stats. a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales or use tax rate on qualifying equipment. beginning on july 1, 2014, manufacturers and certain research and developers, and beginning on january 1, 2018, certain. — in the manufacturing industry, numerous states. Manufacturing Equipment Sales Tax Exemption.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF Manufacturing Equipment Sales Tax Exemption 2017) amended revenue and taxation code (r&tc) section 6377.1,. a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales or use tax rate on qualifying equipment. beginning on july 1, 2014, manufacturers and certain research and developers, and beginning on january 1, 2018, certain. — in the manufacturing industry,. Manufacturing Equipment Sales Tax Exemption.

From www.anrok.com

How to manage sales tax exemption certificates Anrok Manufacturing Equipment Sales Tax Exemption 2017) and ab 131 (chapter 252, stats. 2017) amended revenue and taxation code (r&tc) section 6377.1,. the manufacturers' sales and use tax exemption (m&e) provides a retail sales and use tax exemption for machinery and. a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales or use tax rate on. Manufacturing Equipment Sales Tax Exemption.

From www.formsbank.com

Fillable Form St403 Commercial Farming Machinery & Equipment Sales Manufacturing Equipment Sales Tax Exemption — machinery and equipment used directly and predominantly in the production of tangible personal property. 2017) and ab 131 (chapter 252, stats. assembly bill (ab) 398 (chapter 135, stats. — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. the manufacturers' sales and use tax exemption (m&e) provides a retail. Manufacturing Equipment Sales Tax Exemption.

From www.exemptform.com

Sales Tax Exemption Form Washington State Manufacturing Equipment Sales Tax Exemption — machinery and equipment used directly and predominantly in the production of tangible personal property. assembly bill (ab) 398 (chapter 135, stats. the manufacturers' sales and use tax exemption (m&e) provides a retail sales and use tax exemption for machinery and. a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay. Manufacturing Equipment Sales Tax Exemption.

From www.floridasalestax.com

FL SALES & USE TAX MACHINERY & EQUIPMENT EXEMPTION SIGNED INTO LAW Manufacturing Equipment Sales Tax Exemption — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. 2017) amended revenue and taxation code (r&tc) section 6377.1,. beginning on july 1, 2014, manufacturers and certain research and developers, and beginning on january 1, 2018, certain. a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to. Manufacturing Equipment Sales Tax Exemption.

From www.simpleindex.com

Take control of Sales Tax exemption forms Manufacturing Equipment Sales Tax Exemption assembly bill (ab) 398 (chapter 135, stats. — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. beginning on july 1, 2014, manufacturers and certain research and developers, and beginning on january 1, 2018, certain. — machinery and equipment used directly and predominantly in the production of tangible personal property.. Manufacturing Equipment Sales Tax Exemption.

From www.salesandusetax.com

Texas Sales Tax Exemption for Manufacturing Agile Consulting Manufacturing Equipment Sales Tax Exemption 2017) amended revenue and taxation code (r&tc) section 6377.1,. — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. — machinery and equipment used directly and predominantly in the production of tangible personal property. beginning on july 1, 2014, manufacturers and certain research and developers, and beginning on january 1, 2018,. Manufacturing Equipment Sales Tax Exemption.

From www.exemptform.com

Ma Sales Tax Exempt Form St5 Manufacturing Equipment Sales Tax Exemption — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. assembly bill (ab) 398 (chapter 135, stats. 2017) amended revenue and taxation code (r&tc) section 6377.1,. a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales or use tax rate on qualifying equipment.. Manufacturing Equipment Sales Tax Exemption.

From pascoedc.com

Unlocking Growth Florida’s Manufacturing Machinery and Equipment Sales Manufacturing Equipment Sales Tax Exemption a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales or use tax rate on qualifying equipment. — machinery and equipment used directly and predominantly in the production of tangible personal property. the manufacturers' sales and use tax exemption (m&e) provides a retail sales and use tax exemption for. Manufacturing Equipment Sales Tax Exemption.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF Manufacturing Equipment Sales Tax Exemption assembly bill (ab) 398 (chapter 135, stats. — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. — machinery and equipment used directly and predominantly in the production of tangible personal property. 2017) and ab 131 (chapter 252, stats. beginning on july 1, 2014, manufacturers and certain research and developers,. Manufacturing Equipment Sales Tax Exemption.

From www.performanceracing.com

California Introduces Manufacturing Equipment Sales Tax Exemption Manufacturing Equipment Sales Tax Exemption a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales or use tax rate on qualifying equipment. 2017) and ab 131 (chapter 252, stats. assembly bill (ab) 398 (chapter 135, stats. 2017) amended revenue and taxation code (r&tc) section 6377.1,. the manufacturers' sales and use tax exemption (m&e) provides. Manufacturing Equipment Sales Tax Exemption.

From www.templateroller.com

Form REV27 0021 Download Fillable PDF or Fill Online Sales and Use Tax Manufacturing Equipment Sales Tax Exemption — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. the manufacturers' sales and use tax exemption (m&e) provides a retail sales and use tax exemption for machinery and. 2017) and ab 131 (chapter 252, stats. — machinery and equipment used directly and predominantly in the production of tangible personal property.. Manufacturing Equipment Sales Tax Exemption.

From www.templateroller.com

Form REV27 0021 Fill Out, Sign Online and Download Fillable PDF Manufacturing Equipment Sales Tax Exemption assembly bill (ab) 398 (chapter 135, stats. 2017) and ab 131 (chapter 252, stats. — machinery and equipment used directly and predominantly in the production of tangible personal property. — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. beginning on july 1, 2014, manufacturers and certain research and developers,. Manufacturing Equipment Sales Tax Exemption.

From learningschoolprysur07.z4.web.core.windows.net

Fillable Sd Sales Tax Exemption Form Manufacturing Equipment Sales Tax Exemption — machinery and equipment used directly and predominantly in the production of tangible personal property. — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions. assembly bill (ab) 398 (chapter 135, stats. a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales. Manufacturing Equipment Sales Tax Exemption.

From www.exemptform.com

Fillable Form R 1060 Farm Equipment Sales Tax Exemption Printable Pdf Manufacturing Equipment Sales Tax Exemption assembly bill (ab) 398 (chapter 135, stats. beginning on july 1, 2014, manufacturers and certain research and developers, and beginning on january 1, 2018, certain. — machinery and equipment used directly and predominantly in the production of tangible personal property. — in the manufacturing industry, numerous states provide opportunities for companies to leverage sales tax exemptions.. Manufacturing Equipment Sales Tax Exemption.

From www.energylegalblog.com

Sales Tax Exemption for Manufacturing Held Inapplicable for Oil and Gas Manufacturing Equipment Sales Tax Exemption a partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales or use tax rate on qualifying equipment. assembly bill (ab) 398 (chapter 135, stats. the manufacturers' sales and use tax exemption (m&e) provides a retail sales and use tax exemption for machinery and. 2017) and ab 131 (chapter 252,. Manufacturing Equipment Sales Tax Exemption.